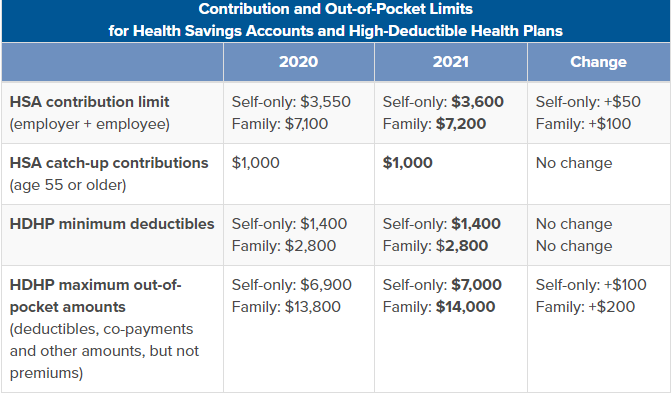

The annual limit on HSA contributions will be $3,600 for self-only and $7,200 for family coverage. That’s about a 1.5 percent increase from this year.

Do not forget these makeup contributions for those over the age of 55.

As part of the Coronavirus Aid, Response and Economic Security (CARES) Act signed into law in March, account holders can now use HSAs, health reimbursement arrangements (HRAs) or health flexible spending account (FSAs) to pay for over-the-counter medications without a prescription. The coronavirus-related legislation also allows HSAs, HRAs and FSAs to pay for certain menstrual care products, such as tampons and pads, as eligible medical expenses. These are permanent changes and apply retroactively to purchases beginning Jan. 1, 2020.